Setting up automatic contributions will allow your savings to grow, without having to think about it. To avoid the temptation of overspending or splurging when you receive your paycheck, you can automate contributions to your savings account. To find a credit union in your area click here. At many credit unions you can open a savings account with as little as $5.00. The first step in building savings is to start, even if it is a small amount. These are not exact percentages, and you can modify them to work for you. Apply 50% of your take-home pay to needs, such as your mortgage or rent, utilities, groceries, and transportation 20% to savings, investments, and debt payments and no more than 30% to your wants or flexible spending, such as travel or entertainment. After evaluating your expenses, then determine a method to allocate your spending.

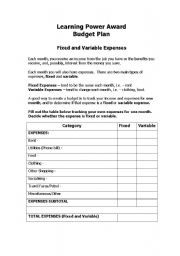

This will give you an idea of how you are spending your money. Worksheet from the Federal Trade Commission, helps you evaluate which expenses are flexible and which are fixed. (You will be leaving and accessing a non-NCUA website.

#Fixed versus flexible expenses worksheet how to

If you do not know how to start, this Make a Budget (opens new window) Create A BudgetĬreating a budget allows you to track, review, and modify where your money is going each month. Below are some tips in each area to help you achieve these financial goals. Top resolutions concerning financial goals include creating a budget, establishing savings, and planning to get out of debt. Make money management a routine: Review your spending patterns and records each week or bi-weekly at a set time.The New Year represents a fresh start and an opportunity to set financial goals for the year.Choose a record-keeping system: Whether it’s a notebook or an app, decide where your budget information will live and stick to it.Don’t forget the little expenses that add up: clothing, ATM fees, dinner out, data overages, etc.Consider a separate bank account for fixed costs and automatic payment plans, so your casual spending won’t leave you short for must-pay bills.Once you’ve paid off your debt, transfer that same monthly amount into a savings account for a future goal.Do you need to subscribe to both Netflix and Hulu? If your fixed expenses are high, reconsider your expenses.You can’t predict every expense that arises. But if your monthly balance leaves you in the black-or better still, with income left over-keep up the good work! You’ll be glad you did. If your expenses outpace your resources, you need to rethink your strategy. Did you stay on track? Was there a shortfall? Are there adjustments that need to be made going forward? Wants are things that you could do without if you had to.Įvery month or two, measure how well your income is balancing against your expenses.Needs are things required for daily life-food, clothing, housing, and unavoidable costs associated with being a student.wants. Needs obviously get priority, and every budget should cover those first. Know the difference between needs and wantsĪ good starting point for creating a budget is to designate needs vs. Saving offers an added sense of financial security and stability, while creating a lifelong habit. The amount you put away doesn’t matter it all adds up. But the best thing you can do financially is to save a little every single month. If you have any resources left after all your expenses are paid, it’s easy to think of the extra as just more spending money.

#Fixed versus flexible expenses worksheet download

Download a budgeting app, keep a tracking document on your laptop, or carry a notebook.

0 kommentar(er)

0 kommentar(er)